At Lockton Wattana, we believe that resilient risk management is crucial to safeguarding your operations and reputation. Among the most significant coverages for businesses reliant on industrial equipment are Machinery Breakdown (MB) and Boiler Explosion Insurance. By protecting your equipment—and the property around it—you can mitigate extensive disruptions, minimize operational downtime, and set your business up for sustainable success.

Understanding the Risks

1. Machinery Breakdown

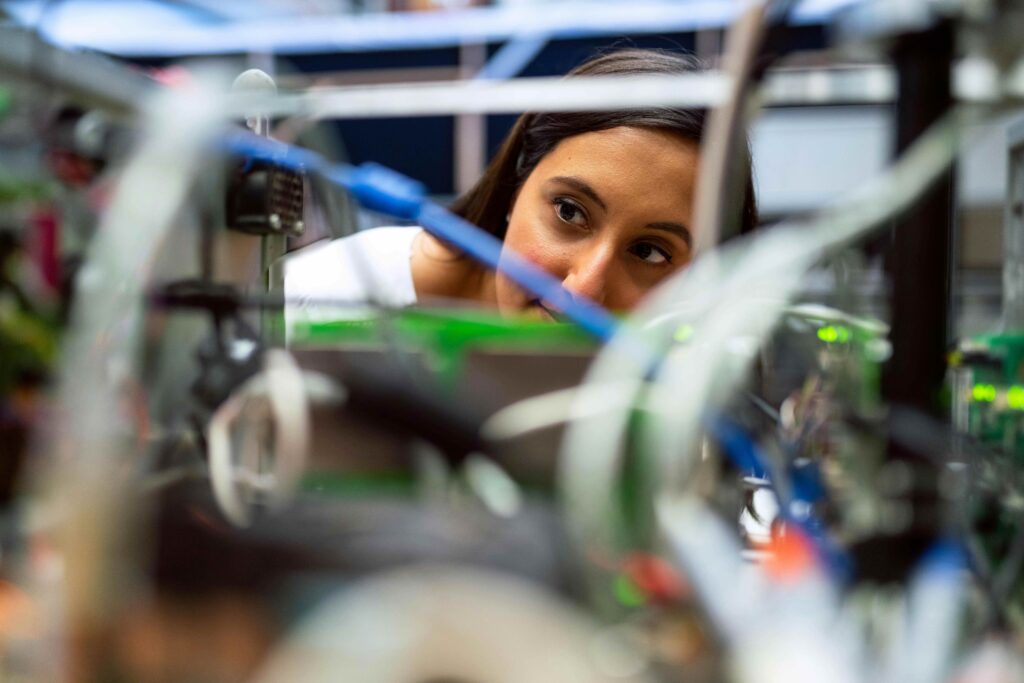

Industrial and commercial equipment often runs under intense conditions, which can lead to wear and tear, overheating, or electrical failure. If critical machinery suddenly grinds to a halt, your entire production line can be affected, leading to costly repairs, product delays, and lost revenue. Machinery Breakdown Insurance is designed to cover the cost of repairs or replacement, helping you maintain consistent uptime and a streamlined workflow.

2. Boiler Explosion

Boilers and pressure vessels power the backbone of many industries—manufacturing, food processing, chemical plants, and more. While highly efficient, they also operate under immense pressure. A single malfunction can result in significant property damage, halted production, and substantial financial losses. Boiler Explosion Insurance covers the repair or replacement of the boiler itself, as well as potential damage to surrounding property.

For more information on this insurance product, click here

Key Benefits of MB and Boiler Explosion Insurance

1. Comprehensive Financial Protection

Both policies cover repair and replacement costs for damaged equipment, allowing you to recover quickly and avoid unexpected capital expenditures. They also extend coverage to damaged property if the breakdown or explosion causes collateral harm.

2. Risk Isolation

Many businesses choose to place Boiler Explosion and Machinery Breakdown coverage on a stand-alone basis. By separating these exposures from an All Risk policy, you gain greater transparency into how claims are managed. This approach lets you tailor each policy to specific business needs, enabling flexible premium and coverage structures.

3. Business Continuity

Equipment failure can trigger a chain reaction of missed deadlines and lost revenue. These policies help secure your investment in critical machinery, allowing you to maintain smooth operations and deliver on your commitments to clients.

4. Peace of Mind

Beyond the financial savings, having MB and Boiler Explosion Insurance in place helps reduce the stress of unexpected breakdowns. You can focus on growing your core business with the confidence that your critical equipment is protected.

Coverage Inclusions and Exclusions

1. Inclusions

- Repair/Replacement of Affected Machinery: Covers damaged or destroyed components.

- Associated Property Damage: Addresses damage caused by a covered event to adjacent equipment or property.

- Business Interruption (Optional Rider): In some cases, you can enhance coverage to include compensation for lost income or additional operating expenses during downtime.

2. Exclusions

- Routine Wear & Tear: Normal deterioration over time typically falls under preventive maintenance rather than insurable events.

- Negligence or Willful Misconduct: Damage caused by improper operation or intentional harm is generally excluded.

- Pre-Existing Conditions: Conditions identified before policy inception may require additional endorsements or may be excluded outright.

Best Practices for Reducing Equipment Risks

While insurance is vital, preventive measures can significantly lower the likelihood of equipment failure:

- Preventive Maintenance: Regular inspections and planned upkeep can detect early signs of wear or malfunction.

- Qualified Operators: Proper training ensures that machinery is used according to safety standards and manufacturer guidelines.

- Emergency Shutdown Procedures: Clear protocols help protect both employees and equipment when malfunctions occur.

- Adhere to Regulatory Standards: Compliance with local and international regulations not only keeps equipment running smoothly but also demonstrates a commitment to safety.

How We Support Your Business

We work with you to assess the specific risks facing your industrial or commercial operations, helping you determine the right coverage. Our dedicated teams are well-versed in identifying gaps in your current insurance program, customizing solutions that offer robust protection without unnecessary overlaps.

By placing Machinery Breakdown or Boiler Explosion Insurance on a stand-alone basis, we can tailor your coverage while granting you greater control over how claims are handled. Ultimately, our goal is to ensure your business is prepared for every contingency, from minor equipment hiccups to large-scale boiler incidents.